^ Waived $90 +GST set up fee on joining which you only pay if you leave before 12 months.

Most banks and other EFTPOS providers charge you fees based on the type of card your customer uses to pay (international cards and premium cards cost you more!). Rather than paying different rates for different cards, Simple Flat Rate means you pay one low rate for every Visa, Mastercard and eftpos transaction. This means you’ll know what you’ll pay each month.

EFTPOS, Debit, Visa and Mastercard cards are included. AMEX can be added to your terminal but isn’t included in the flat rate.

It’s a fixed percentage for all credit and debit card transactions and a fixed cent rate for eftpos.

This rate is calculated for each individual business, ensuring you get the best deal possible. Get started now to find out your rate.

Tap & Pay payments attract the same rate as cards that are inserted and require the customer to enter a PIN.

Any business can apply for Simple Flat Rate.

There is no penalty for growing your sales – we won’t charge you a higher rate for a better-than-expected turnover. However, if your expected turnover doesn’t match the quote provided we can work together to update your rate, ensuring you get the best rate possible.

No. There is no minimum term for Simple Flat Rate.

Your earnings are settled into your account the next business day. This means we settle Monday, Tuesday, Wednesday and Thursday transactions the next day. Friday, Saturday and Sunday transactions are settled on Monday. The funds are available to you depending on your bank’s processing. Public holidays settlement will be deposited on the next business day.

You have the freedom to choose any Australian business bank account for your settlement when you pick Smartpay for your EFTPOS.

The monthly terminal rental cost for Simple Flat Rate is $34.95+GST. Looking to eliminate your merchant fees and terminal rental? Try Smartpay Zero Cost™ EFTPOS.

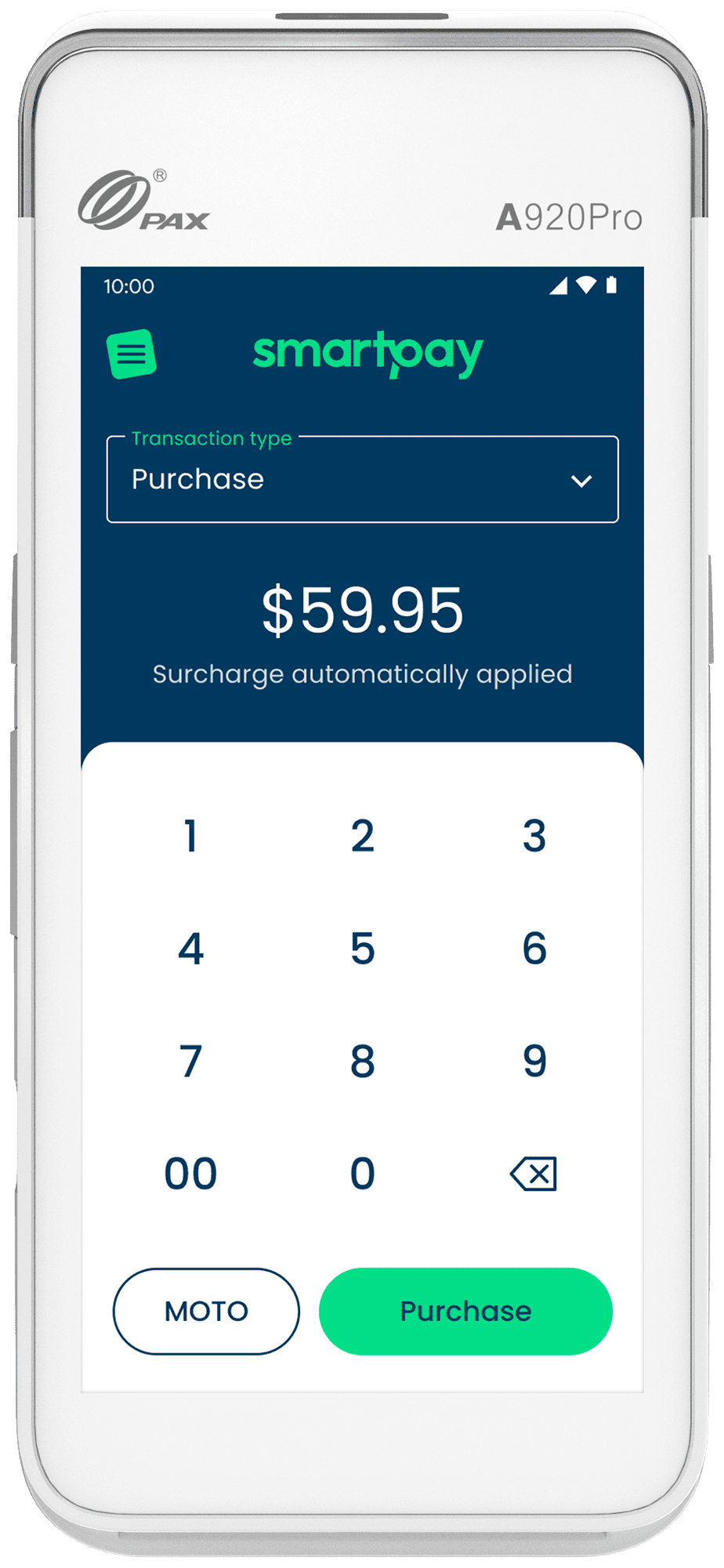

You will receive a lightweight, portable Android terminal that can connect via a 4G Sim Card (provided by Smartpay), Wi-Fi or broadband. It can support free add-on functions like Tap n Go, Tipping, Mail Order/Telephone Order (MOTO) and is fully compatible with Apple Pay, Google Pay and Samsung Pay.

Once your application is approved, we’ll send your terminal within 5-9 business days.

Yes. However, paper rolls are charged at the lowest cost possible, with an included fixed-rate delivery fee. You can also turn off printing receipts.

Our 24/7 local customer support is here to help! Simply call 1800 574 999 and our team will help you. If you experience a problem with your terminal that can’t be resolved by our technical support team over the phone, we will courier you a replacement terminal at no cost.

No! Your Smartpay terminal will be upgraded automatically and free of charge.

Find out in less than a minute