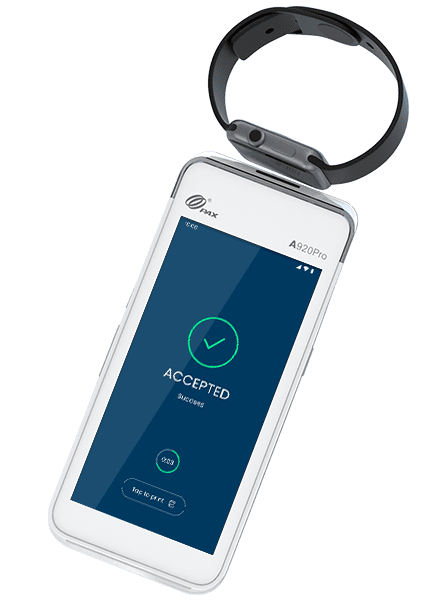

Enjoy all the best EFTPOS features with Smartpay, without the cost. As a compact countertop solution or portable and unplugged, our all-in-one Android EFTPOS terminal does it all. Easy to set up and pairable with multiple POS providers, our credit card reader seamlessly fits into your business.

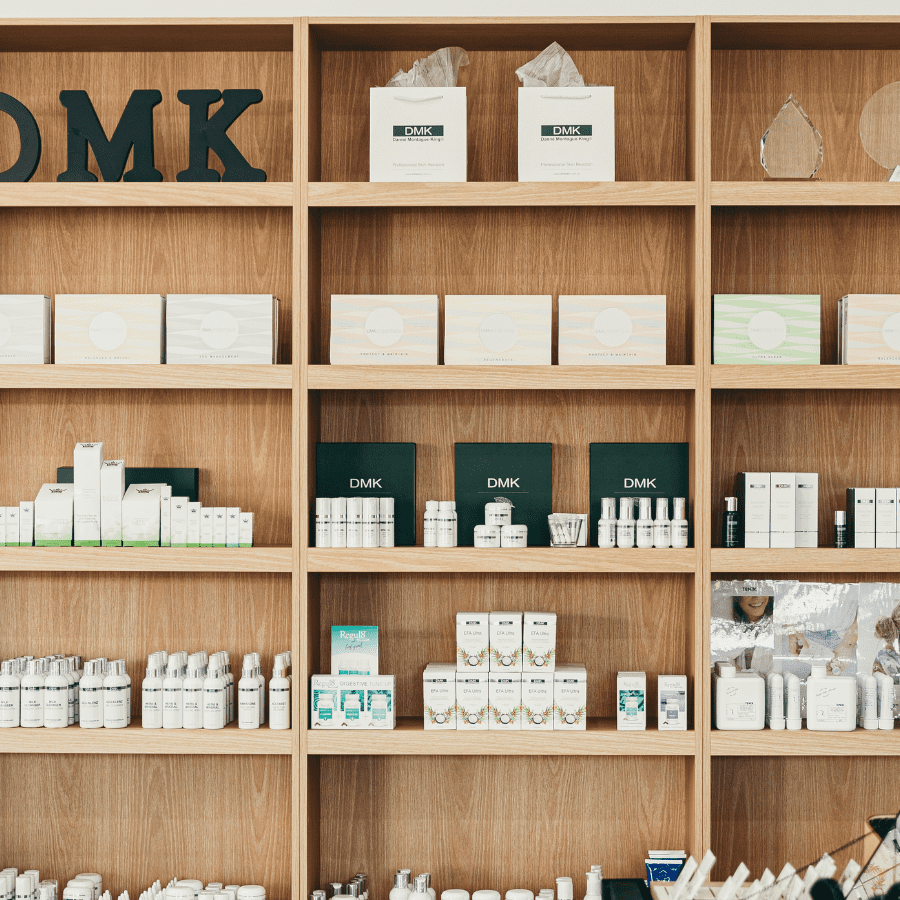

We’ve got your back when it comes to payments. We’re powering over 30,000 businesses across Australia and New Zealand with reliable payment solutions that help them save on fees.

Process all major debit and credit cards – Visa, Mastercard, EFTPOS and American Express. Accept contactless payment methods from cards, smartphones or wearable devices.

Let customers pay how they want. Our card machine is flexible for all EFTPOS transactions, whether it be a tap, insert or swipe payment.

Our Android machines make contactless payment easy, accepting Mastercard Tap & Go and Visa payWave.

Smartpay terminals accept payments from smartphone and watch devices, including Apple Pay, Google Pay, Samsung Pay or Android Pay.

Our card reader accepts all major credit and debit cards, including Mastercard or Visa, and the free option to add on American Express.