Picture this: you’re a modern business owner with a whole stack of things to take care of each day. On top of serving customers, marketing your business to attract new ones and making sure you’re earning enough money, you’re also expected to be a maven on merchant fees? Ugh.

Well, those days are over. Smartpay is here to answer the question, what are merchant fees and help you understand the what and why. But more importantly, we want you to know how you can stop paying them.

So here’s everything you need to know about merchant fees.

We know that running a business is a lot. And with everything else you have going on, educating yourself on merchant service fees probably feels like a task. I mean, what is a merchant fee? Okay, let us simplify. Merchant account fees are the payments you make to your bank or provider to process your transaction payments. This fee is typically calculated as a percentage (or fixed fee) of each transaction where a card is used, including tapping, swiping and inserting.

On top of this, there are other included fees, like one to the issuing bank, a scheme fee (Visa, Mastercard, EFTPOS, etc) and a switch fee to whoever processed it.

With all these fees flying around, it’s the issuing bank who gets the biggest cut. That’s usually because of the interchange fee, which can partly fund expensive reward point programs and the costs of issuing the card. As the business owner, you typically have to cough up the dough for this merchant service fee.

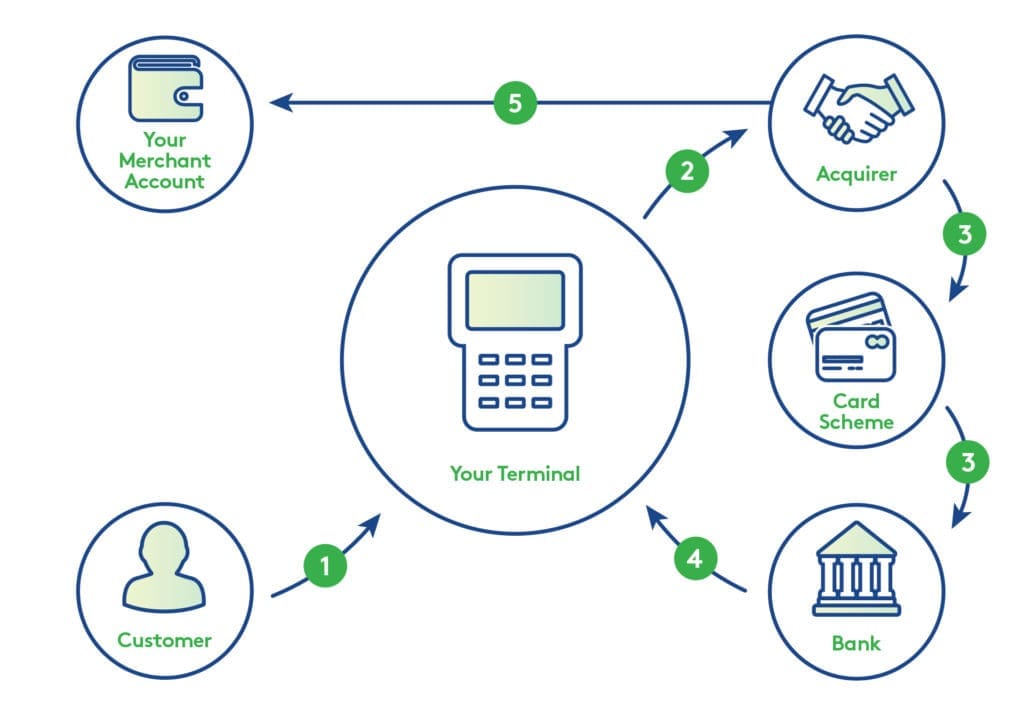

Technically, you don’t. But we’ll get to that later. To understand why you might pay a merchant service fee, here’s how electronic payments work.

Sure, that’s a simplified version, but it’s enough to demonstrate two things.

1. There are plenty of players involved.

2. There is a lot of technology and expertise involved. Every day in Australia, the EFTPOS system handles more than 6 million transactions via 981,000 terminals. That’s more than 4,000 transactions per minute. And what pays for all this? In part, your merchant service fees.

What are merchant service fees? Check out our video on merchant fees and how to reduce them.

By now, you’ve probably guessed that merchant service fees can add up to a hefty sum. And even if you’ve realised you could get a better deal by switching EFTPOS providers, who’s got the time?

That’s where Smartpay comes in. We make it simple to smarten up your payment solutions, and either reduce or slash entirely your merchant service fees. How, you ask? Smartpay’s Simple Flat Rate or Smartpay Zero Cost™ EFTPOS solutions.

Our Simple Flat Rate option lets you pay a set rate for every credit and debit transaction. So, you’ll pay the same fee for every transaction, no matter what card the customer uses. Unlike an all-inclusive pricing plan, you only pay for what you use. Hello, budget bliss.

But while our Simple Flat Rate allows you to reduce merchant service fees, Smartpay Zero Cost™ EFTPOS gets rid of them altogether. You pass on the fair cost of the transaction to your customer by adding a small surcharge to every sale. Each day, Smartpay takes the fees, so there’s no need for a pesky reconciliation at the end of the month.

Merchant fees can be a real bummer for your business expenses. And if you’re worried about what they’re costing each month, it’s time to shop around.

Feeling iffy about surcharging your customers? We get it. Check out our customer success stories, where you can read about their real experiences with their customers and the support they have received to switch to a surcharging payment model.

Let Smartpay take care of your payment solutions while you focus on your business thriving. Learn more about Smartpay’s Simple Flat Rate and Smartpay Zero Cost™ EFTPOS solutions and how they can work for you.

Understand the ins and outs of surcharging and whether it’s a good fit for your business. Smartpay’s Payment Specialists can help, so get in touch today.

or Contact Sales on 1800 574 999

Find out in less than a minute