Choosing an EFTPOS provider shouldn’t be like playing chess against a grandmaster! That’s why we created this easy guide, helping you find the best EFTPOS solution for your business.

It’s important you get the right EFTPOS solution for your business. Here are the key things you should consider when choosing an EFTPOS provider.

Make sure to consider if your business has any must-haves. For example, do you need:

Ensure that your EFTPOS provider includes any of your must-have features.

Your main costs when it comes to EFTPOS are going to be:

As well as the above, there can be a number of other fees, including:

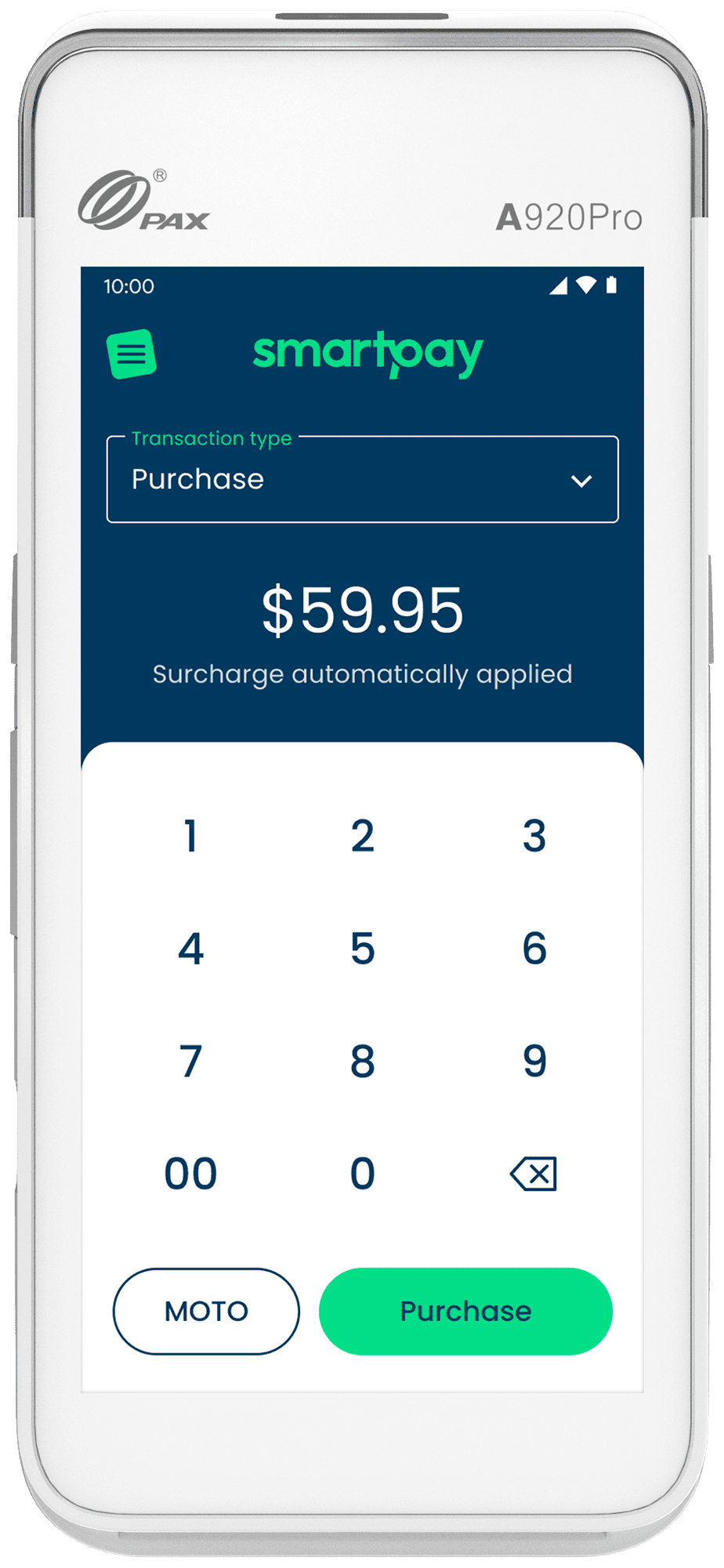

These fees can be confusing and can really add up. That’s why we came up with Smartpay Zero Cost™ EFTPOS. With Smartpay Zero Cost™ EFTPOS you pay… nothing!* Literally. If your business processes $10,000 or more in card transactions per month, you could be eligible for Smartpay Zero Cost™ EFTPOS. Terms and conditions apply.

Customer support - the thing you hope you never need, until you do!

Whether it be connecting to POS, printing receipts, ordering additional terminals, etc. it’s likely you’ll need to contact support at some point. It’s important you get the right support, when you need it. Choose an EFTPOS provider that provides 24/7 local support.

Not to toot our own horn, but Smartpay has 24/7 AUNZ-based support with quick response times and helpful answers on hand. Need help with your terminal at 3AM? We’re just a phone call away!

Generally speaking, linking your EFTPOS machine to your point-of-sale (POS) means that you can take payments quicker than manual entry. POS integration can also mean easier stock keeping and inventory management. If you think your business could benefit from POS integration then try to select an EFTPOS provider that integrates with your POS system. Smartpay integrates with a number of POS systems.

Submit and enquiry and speak with a helpful Smartpay Payment Specialist.