For a limited time only, let us try and beat your rate (minimum turnover and T&Cs apply). Learn more

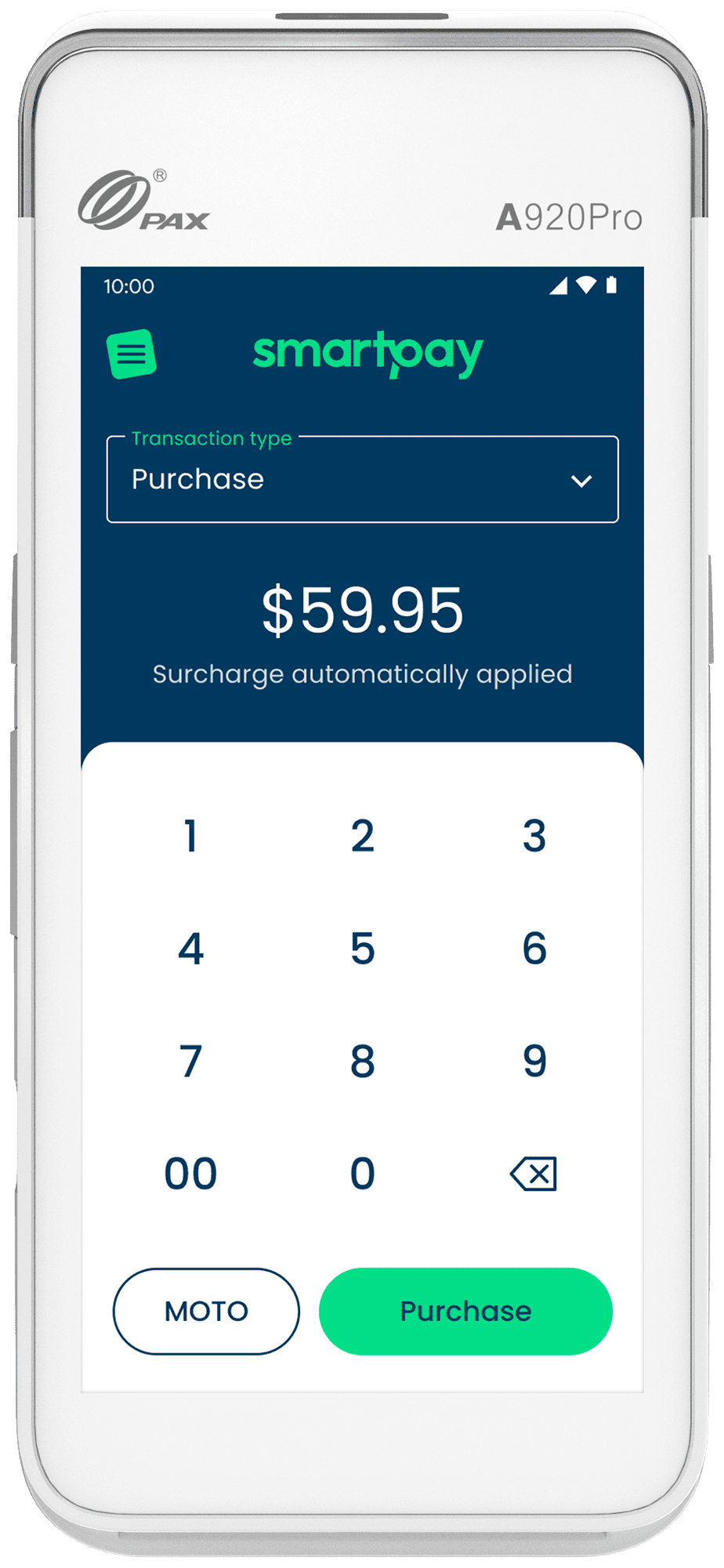

Our EFTPOS terminal can connect via a free 4G SIM card (provided by Smartpay), Wi-Fi or Broadband. It can support add-on functions like Tap ‘n’ Go, tipping, mail order/telephone order (MOTO), and surcharge add-on.

Any business with an average turnover of over $10,000 per month in card transactions can apply for Smartpay Zero Cost™ EFTPOS. If your turnover is below this in a particular month, you’ll be charged a terminal rental of $34.95 + GST, but you won’t have any transaction fees to pay.

We waive the $90 plus GST set-up fee on joining, and you only need to pay it if you leave before 12 months.

Many of our customers find their customers accept a minimal surcharge. Surcharges are now common in many industries, such as bars, cafes, restaurants, automotive services and professional services.

We provide countertop signage with each terminal to make sure that you’re clearly communicating the surcharge amounts to your customers before they pay. The terminal also clearly separates the amount on the screen when they confirm the amount to pay.

You can choose to pay the surcharge for your customer on a particular transaction by bypassing this on the terminal.

EFTPOS, debit, Visa and Mastercard are included. AMEX can be added to your terminal if you have an AMEX merchant ID, though AMEX will still charge you fees for these transactions.

No, you don’t need to worry about that! Smartpay Zero Cost™ EFTPOS is hassle-free, with no admin or manual calculation needed on your part.

If you choose to manage a surcharge yourself, it means:

You need to calculate your own acceptable surcharge. The RBA set a standard to ensure that a business’s surcharge does not exceed the actual cost of accepting the payment. If you choose to apply a surcharge yourself, you must be sure it does not exceed the costs of processing payments, or you could face a penalty for excessive surcharges. To set an appropriate surcharge, you’d need to work out your cost of acceptance for each payment type.

You still get a bill for transaction fees at the end of the month. You’ll have to be on top of it to ensure the surcharge fees you have collected cover that bill.

Admin work to split from your sales. It also means that it will come through as part of your sales, so there could be additional admin for you to split that out from your sales.

With Smartpay Zero Cost™ EFTPOS, all this manual work on your end goes away! However, if you prefer an option where you still control the surcharge yourself, we do offer this add-on with our Simple Flat Rate.

There’s no penalty for growing your sales – in fact, the more you earn, the more you save on merchant fees!

No. There’s no minimum term required for Smartpay Zero Cost™ EFTPOS. If you leave before 12 months, you’ll just need to pay the set-up fee that is initially waived ($90+GST).

Your earnings are settled into your account the next business day. This means we settle Monday, Tuesday, Wednesday and Thursday transactions the next day, and Friday, Saturday and Sunday transactions on Monday. The funds are available to you depending on your bank’s processing.

There’s no need to ditch your business bank! With Smartpay, you have the freedom to choose any Australian business bank account for your settlement.

There is no terminal rental as long as your terminal processes $10,000 of card transactions in that month. If you don’t meet this amount in any given month, you’ll simply pay $34.95 (plus GST) for that month per terminal.

Once your application is approved, it typically takes 5–9 business days for the terminal to arrive.

Yes. Paper rolls are charged at a low fee, with an included fixed-rate delivery fee. You can order paper rolls here.

You will have access to our dedicated technical support service 24 hours a day, seven days a week. Simply call our experienced team, and they will help you. If you experience a problem with your terminal that can’t be resolved by our technical support team over the phone, we’ll courier you a replacement terminal at no additional cost.

No. Your Smartpay terminal will be upgraded automatically free of charge during the life of your lease.

Find out in less than a minute