* Minimum Turnover and Terms & Conditions Apply

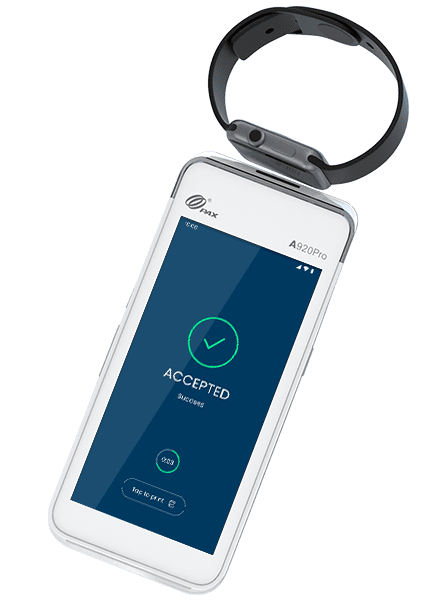

Process all major debit and credit cards – Visa, MasterCard, EFTPOS and American Express. Accept contactless payment methods from cards, smartphones or wearable devices.

Our Android machines make contactless payment easy, accepting Mastercard Tap & Go and Visa payWave.

Smartpay terminals accept payments from smartphone and watch devices, including Apple Pay, Google Pay, Samsung Pay or Android Pay.

Our card reader accepts all major credit and debit cards, including Mastercard or Visa, and the free option to add on American Express.