Smartpay Zero Cost™ EFTPOS Rejuvenates Spa With $10K Savings

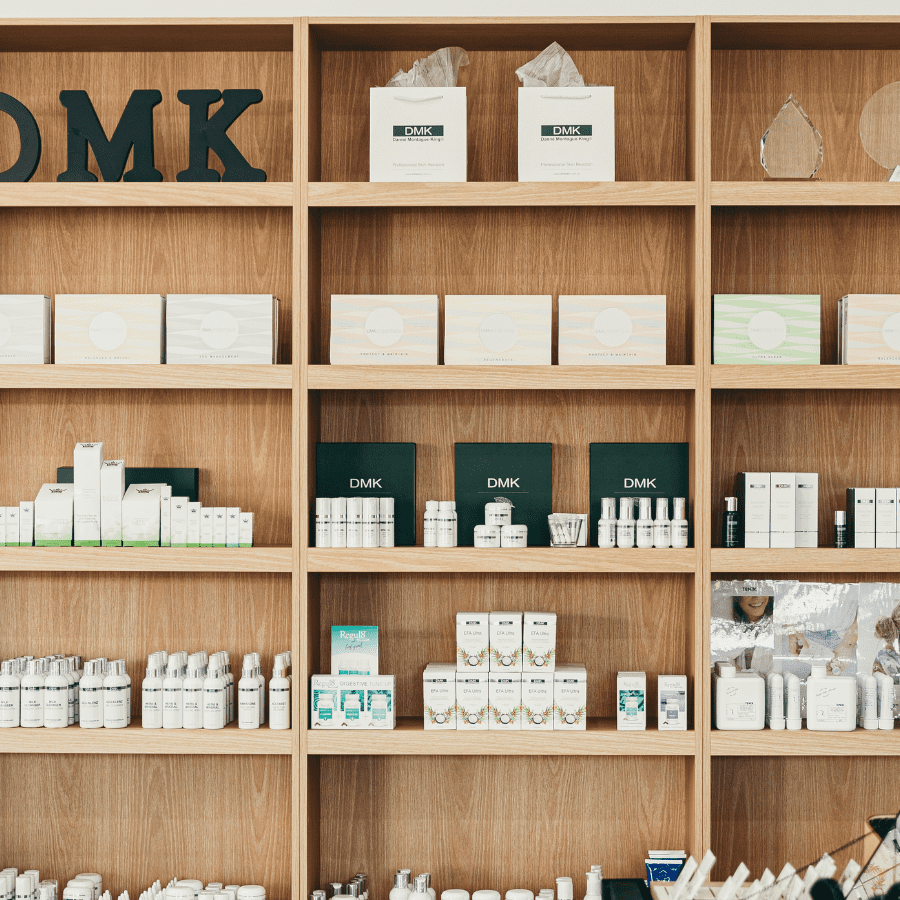

Eclipse the Essential Spa

NSW

Just as people care about their skin, so should businesses care about their payment solution.

For Eclipse the Essential Spa, a recent change to their payment regime rewarded the business with a $10K annual savings.

“With Covid, everyone was paying with their card, and our costs went up immediately,” says owner Tracy.

That was before they made the switch to Smartpay Zero Cost™ EFTPOS.

“With Covid, everyone was paying with their card, and our costs went up immediately,” says owner Tracy.

That was before they made the switch to Smartpay Zero Cost™ EFTPOS.

“We were paying the bank about $700 per month, up to $2,000 during our busiest month.”

Smartpay Zero Cost™ EFTPOS a game-changer for small business

“Our card transaction costs were getting out of hand, and we were considering increasing our prices. We couldn’t absorb the costs. Then we heard about Smartpay Zero Cost™ EFTPOS from one of our clients who owned a restaurant."

“It eliminated the card costs and made reconciling EFTPOS transactions simple. It sounded ideal! We got in touch with Smartpay, and we’ve never looked back.”

“It eliminated the card costs and made reconciling EFTPOS transactions simple. It sounded ideal! We got in touch with Smartpay, and we’ve never looked back.”

"She told us switching to Smartpay Zero Cost™ EFTPOS was a game-changer for her business."

Tracy

Eclipse the Essential Spa

Discovering the perfect treatment for card transaction fees.

Smartpay Zero Cost™ EFTPOS eliminates transaction fees for merchants. Instead, the solution automatically generates a surcharge that’s fair and reasonable and adds this to the final bill for the customer to pay. As a result, there are no transaction fees for the merchant and no complicated EFTPOS reconciliations at the end of the day.

“The team at Smartpay are great – they made switching so easy,” Tracy says.

“The team at Smartpay are great – they made switching so easy,” Tracy says.

“I am not a tech-savvy person; they took care of everything. The terminal arrived, and it was all simple plug-in and play stuff.”

Customers still smiling after change

So did the switch to a surcharge cause frown lines for her clients? Hardly any, according to Tracy.

“We’ve been operating in our local area for 23 years. We built this business from a team of two into a team of 12. So I was a little concerned about the reaction before making the change. But I knew my client had recommended Smartpay, and she was using Smartpay Zero Cost™ EFTPOS successfully. That gave me confidence,” Tracy explained.

“After switching over, we placed a sign on our counter and told our customers about the change.”

“The odd one prefers to pay by cash, and that’s absolutely OK. Our customers have the choice and still get our most competitive prices. They’re happy with that, and so are we. I feel everyone is winning here.”

“We’ve been operating in our local area for 23 years. We built this business from a team of two into a team of 12. So I was a little concerned about the reaction before making the change. But I knew my client had recommended Smartpay, and she was using Smartpay Zero Cost™ EFTPOS successfully. That gave me confidence,” Tracy explained.

“After switching over, we placed a sign on our counter and told our customers about the change.”

“The odd one prefers to pay by cash, and that’s absolutely OK. Our customers have the choice and still get our most competitive prices. They’re happy with that, and so are we. I feel everyone is winning here.”

“Our clients have been very supportive, and 98% have no issue.”

Savings brings a healthy glow to business

“We are saving close to $10,000 annually, which has helped with our cash flow and other business expenses,” Tracy says.

“I have already recommended Smartpay to other businesses and will continue to recommend it. My client was right: It is an absolute game-changer.”

“I have already recommended Smartpay to other businesses and will continue to recommend it. My client was right: It is an absolute game-changer.”

“The last two years have been very challenging. During our lockdowns, we still had many overheads, so we are lucky to have switched to Smartpay Zero Cost™ EFTPOS.”

How Eclipse the Essential Spa is benefiting with Smartpay

$

10,000

Savings Per Year

Based in

NSW

Check Out Our Customer Success Stories

Want to Save Like Eclipse the Essential Spa?

Easy-breezy EFTPOS is just a click away! Join over +30,000 happy customers, contact us now.